What is Jantri?

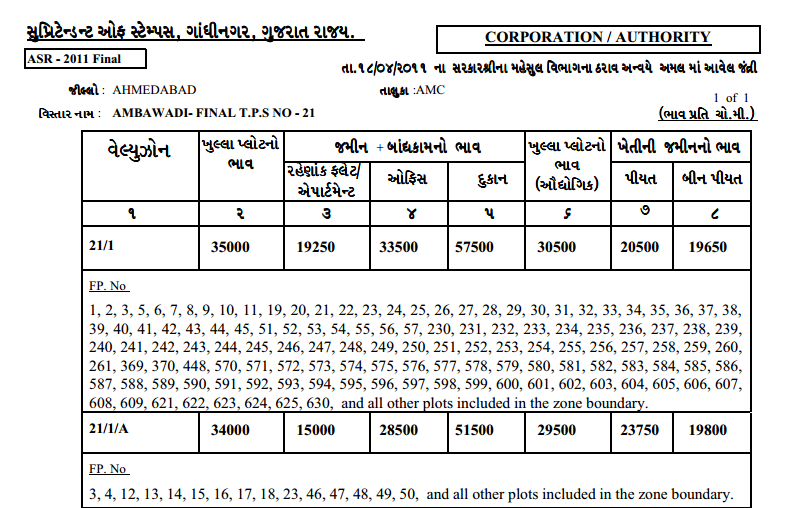

Jantri rates are the minimum price of land / building in a particular area or Jantri is the government document which specifies the market price of the land and buildings.

On the basis of Jantri rates government decides stamp duty to be collected in any sales deed of land or building.

In this, price (Jantri) of each land is decided by revenue department of state government depending on its Location. Stamp Duty is the fixed percentage of tax payable to the government on registration of each property ownership transaction. Even the Central Government’s Income tax department considers Jantri price for the purpose of Capital Gain’s tax calculation. Prior to developing Jantri, the valuation of any immovable property was established by the government officer. This used to result in lot of favors & scrupulous transactions. To avoid this Jantri system has been developed by the government. Till today there are certain loop holes in the system, if they are rectified this is an excellent tool to facilitate clean transactions.

In year 1999, Gujarat Government prepared the first jantri. However, the market prices quoted for each land were for the base year of 1997 during which the market was booming and real estate developments were on its peak, amidst high speculation. These Jantri prices were not scalable and non-scientific, which means there was no mechanism to update them with changing market scenario. Year 1998 to 2003 saw a major period of recession which included a devastating earthquake in year 2001 & a small period of social unrest in 2002. Land prices had plummeted and by year 2003 all cities of Gujarat witnessed heavy recession. This heavy burden of Stamp duty has been borne not only by the real estate industry but also by the common man. Come 2006, and government is preparing a new Jantri (which may be scalable) as heard from industry sources. In this exercise CEPT has been appointed as the consultant to the state government.

Jantri Prices are primarily based on certain auctions of the plots which are very specifically sold at high premium mainly by big corporate houses & large scale real estate operators who are willing to pay premium due to surety of legal titles & further these plots are located at very strategic locations where all the developments have already happened.

In present system certain value zones are established at macro levels, but within the same value zone the land prices of all the plots cannot be same. There are certain negative factors which are attached to any parcel of land, like width of the road on which a plot abuts, frontage to depth ratio, adjoining slum or hutments, titles of the property, certain religious & sentimental factors, proximity to high tension electricity supply lines, crematorium, socio-economic pattern, stage of infrastructure, development, etc.

Today, the burden of paying Stamp Duty is passed on to the consumer. While this may be the scenario for all newly levied taxes (such as Service Tax and VAT), the Jantri proves to be much more lethal than any other tax tool. Here’s why. Imagine you bought a house today. It is assumed that you will most likely not stay in it for your entire life. Either by professional growth you will upgrade to a better house or in crisis may have to sell off the same for money. In either case, the buyer of your house will be a common man, just like yourself, not necessarily a part of real estate industry. Stamp Duty will be levied on property transactions, based on prevailing Jantri Rates. It is believed that only 40% of total revenue collected by means of Stamp Duty is from the newly constructed built-up stock or land deals. More than 60% of total revenues from Stamp Duty are collected by sale and transfer of real estate property MUTUALLY among common buyers. This makes Jantri more of a social issue rather than a real estate agenda.

This raises a big question, what is the significance of JANTRI? Varying stamp Duty rates do not come into picture. JANTRI prices should be more realistic, scientific and simple to understand. When considering Land, Prices should be adjusted based on several locations, legal, physical and planning parameters. When considering built property, Depreciation of construction should be considered and there should be different rates based on how old the construction is? For example, more than 3 years, 5 years, 9 years or 15 years. As built properties such as a Flat or apartment does not have an alternate Land use by single owner, land appreciation should be ruled out while considering its value and only depreciation of constructed value should be considered. While calculating the construction Jantri prices, various factors such as type of Structure, infrastructure provisions, maintenance condition and specifications will have play a vital role to decide the construction Jantri prices.

Take real estate sector for example. If you consider the total tax component on the final built product, it comes to around 27% of total product value. This means that if you are purchasing a Flat worth 15 Lakhs, than Rs. 4.06 Lakhs is the total taxes that are included in this final price. Had there been no taxes, the value of this flat would have been 10.94 Lakhs only. These are alarming numbers and the following is the justification of these numbers. The above tax model is certainly taxing, especially for consumers. This is an alarming situation. This a very heavy burned on lower and middle income people and spoils other incentives for creating new housing stock and it will indirectly attracts illegal transactions and loss on state exchequer.

Property Knowledge By Autoscale.