What is stamp duty & why to pay it?

Possession is the physical transfer of the property is not sufficient. You also need to have legal ownership. At the time of registration, you will also have to pay a stamp duty which is a government tax levied on property transactions.

Buying a house is one of the biggest financial decisions that you will make in your life. It is an overwhelming experience, both financially and emotionally. While buying a house, we need to identify the property, make down payment, apply for loan, sign the sale agreement, etc. One of the important step & the final step while buying a house is the possession and registration of your property. After the possession of the property is being transferred to you, it is your responsibility to get it registered in your name.

Possession is the physical transfer of the property, but it is not sufficient. You also need to have legal evidence of ownership. For this you will have to get the property registered in your name in the local municipal records, with the seller documenting that the property is being transferred to you. At the time of registration, you will also have to pay a stamp duty which is a government tax levied on property transactions. In this article let’s try to understand what is stamp duty, why is it essential to pay stamp duty and many more aspects of stamp duty.

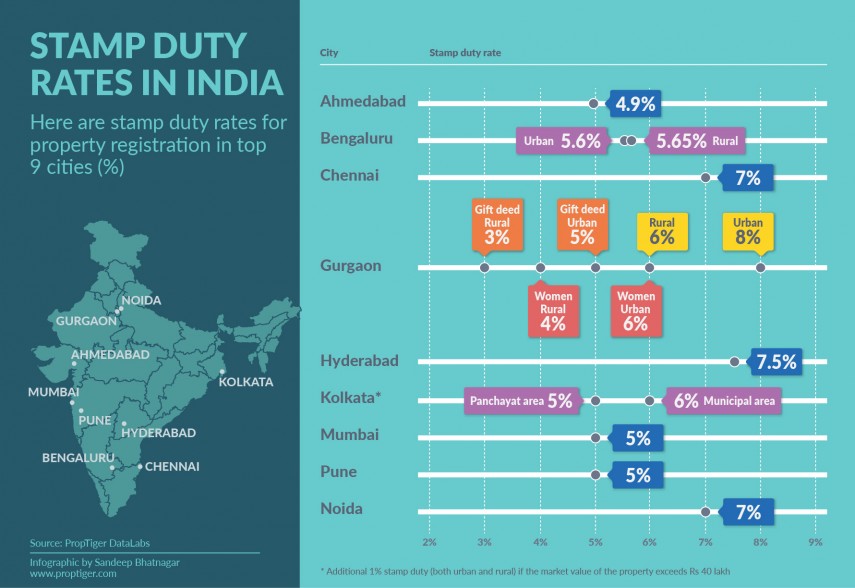

Stamp duty is collected on the basis of property value at the time of registration. Stamp duty’s amount varies from state to state and also property type—old or new. Since it adds up to the property cost, it’s better to have a fair idea before you finalise your property deal.

Stamp duty is a legal tax payable in full and acts as an evidence for any sale or purchase of a property. The levy of stamp duty is a state subject and thus the rates of stamp duty vary from state to state. The Centre levies stamp duty on specified instruments and also fixes the rates for these instruments.

It is usually paid by the buyer with regardless to agreement and in case of property exchange, both seller and the buyer has to share the stamp duty equally.

What is stamp duty?

It is a tax, similar to income tax, collected by the government. Stamp duty is payable under Section 3 of the Indian Stamp Act, 1899. Stamp Duty must be paid in full and on time. If there is a delay in payment of stamp duty, it attracts penalty. A stamp duty paid instrument / document is considered a proper and legal instrument / document and has evidentiary value and is admitted as evidence in courts. Document not properly stamped, is not admitted as evidence by the court.

When is the stamp duty payable?

It is payable before execution of the document or on the day of execution of document or on the next working day of executing such a document. Execution of the document means putting signature on the instrument by the person’s party to the document.

What is the penalty charge?

Any delay in duty payment will pull in 2% per month to the maximum of 200% of the deficit amount of stamp duty. Stamp papers are to be purchased in the name of either of the parties, i.e, seller or buyer involved in the agreement, failing which will disable the stamp paper. It is said to be valid for six months from the date of purchase, only if the duty is paid on time.

Who is liable to pay?

In the absence of any agreement to the contrary, the purchaser/transferee has to pay stamp duty or in case of exchange of properties, both parties have to bear stamp duty equally.

How should one sign an instrument affixed with adhesive stamp?

According to the provisions of Section 12, any person executing an instrument—affixed with adhesive stamp—shall cancel the adhesive stamp by writing on or across the stamp his name or initials. If such an adhesive stamp has not been cancelled in the aforesaid manner, such a stamp is deemed to be unstamped.

What is instrument?

Instrument means any document by which any right or liability is, or purports to be, created, transferred, limited, extended, extinguished or recorded. It is payable on instruments and not on transactions. Stamp duty should be charged on the basis of the contents of the instrument only. If any information essential for working out stamp duty is missing in the instrument, valuation officer can call for it. Information such as the area of the flat, number of the floors and year of construction must be mentioned in the agreement for quicker response.

How should instruments stamped with impressed stamp be written?

As per the provision of Section 13 of the Indian Stamp Act, 1899, any instrument on an impressed stamp, shall be written in such manner that the stamp may appear on the face of the instrument and cannot be used for or applied to any other instrument i.e., cancel the adhesive stamp so affixed by writing on or across the stamp his name or initials. If such an adhesive stamp has not been cancelled in the aforesaid manner, such a stamp is deemed to be unstamped.

Property Knowledge By Autoscale